ADJUDICATION OF PENALTIES UNDER SECTION 454 OF COMPANIES ACT, 2013

The Registrar of Companies(“ROC”) is entrusted with various responsibilities under the Companies Act, 2013 (“Act”) and one of them is to adjudicate penalties as per Section 454 of the Act.

Section 454 of the Act authorises the RoC to impose penalties on:

- company

- officer who is in default or

- any other person

by issuing an order stating the non-compliance or default under relevant provisions of the Act.

Further, ROC is authorised under Rule 3 of the Companies (Adjudication of Penalties) Rules, 2014 (“Rule”) to:

- Issue show cause notice for seeking explanations for the claims made by the RoC

- Summon and enforce the physical appearance of any person acquainted with the facts and circumstances, and

- Order for evidence or to produce any relevant document.

The relevant provisions of the Act focus only on adjudicating the quantum of penalty i.e. penalty being monetary in nature and not otherwise.

The ROC before imposing any penalty is required to give a reasonable opportunity of being heard to the company, the officer who is in default, or any other person.

The person aggrieved by the order of ROC can file an appeal to RD.

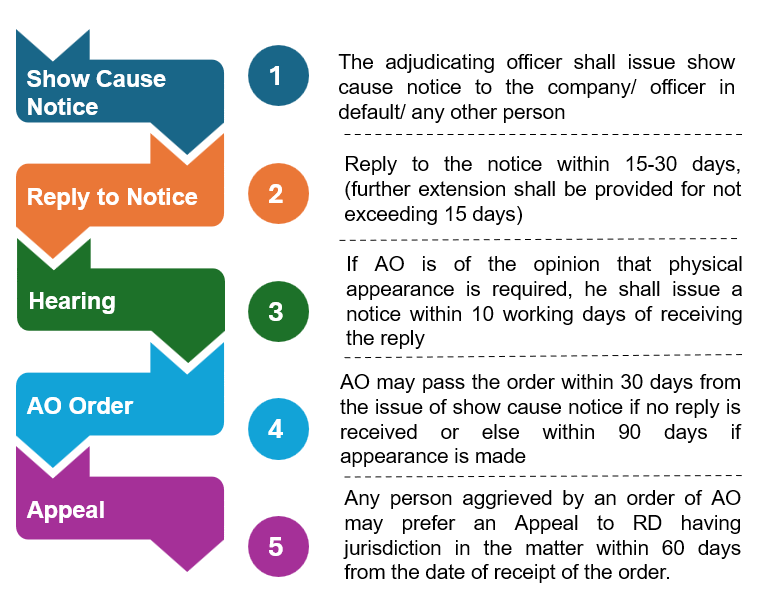

The Act and Rules have laid down a detailed timeline to be adhered by ROC and the aggrieved person while dealing with notice under Section 454.

ROC recently has been sending notices to companies for various defaults under the Act including but not limited to the following:

- Non-reporting of significant beneficial ownership under Section 90

- Non-maintenance of registered office for receiving communication on behalf of the Company

- Non-filing or incomplete filing of Form AOC-4 (Filing of financial statement) and Form MGT-7 (Annual Return)

- Non -compliance with CSR requirements

- Non- appointment of Company Secretary/other KMPs

- Non-appointment of Independent Directors

- Non-constitution of committee

- Non-compliance with provisions regarding acceptance of deposits

- Non-compliance with provisions regarding issuance of shares.

SUO MOTO APPLICATION

Section 454 of the Companies Act, 2013 does not explicitly provide for voluntary applications by the company, officer who is in default or any other person as the case may be. However, the Registrar of Companies has been receptive to applications pertaining to instances where a company has failed to comply with provisions of the Companies Act, 2013.

Accordingly, if the default is made with respect to the provisions under the Companies Act, 2013 which are liable for “penalty”, then the Company, officer in default or any other person can suo moto make an application for rectifying the default under said provisions.

Suo moto applications have been filed by Companies for many non-compliances including following:

- Delay in filing Form INC 20A (Declaration of commencement of business)

- Delay in filing the Form BEN -2 within the prescribed timeline

- Non- maintenance of minimum number of Directors on the Board as per Section 149(1)

- Delay in convening the Board meeting beyond the prescribed timeline

- Filing of incorrect details in Form PAS-3

- The delay in issuance of share certificate beyond the prescribed timeline under Section 56.

- For not holding 4 board meeting in a calendar year

In conclusion: Section 454 of the Companies Act, 2013 grants the Registrar of Companies (ROC) authority to impose penalties for various non-compliances. Recent notices indicate active enforcement targeting a range of violations. Additionally, while the provision doesn’t explicitly allow voluntary applications, the ROC considers suo moto applications for rectifying defaults. Adjudication of penalties under Section 454 ensures corporate governance standards and regulatory compliance, emphasizing the need for vigilance among companies and individuals to avoid penalties and maintain legal standing.

PDF version is attached: Adjudication of penalties under section 454 of Companies Act, 2013

DISCLAIMER: – The summary information herein has been compiled by our expert regulatory team based on section 454 of Companies Act, 2013 read with the Companies (Adjudication of Penalties) Rules 2014. While the information is believed to be accurate, we make no representations or warranties, express or implied, as to the accuracy or completeness of it. Readers should conduct and rely upon their own examination and analysis and are advised to seek their own professional advice. This note is not an offer, advice or solicitation. We accept no responsibility for any errors it may contain, whether caused by negligence or otherwise or for any loss, howsoever caused or sustained, by the person who relies upon it.