Background

The importance of inclusive growth is widely recognized as an essential part of India’s quest for development. In line with this national endeavor, Corporate Social Responsibility (CSR) was conceived as an instrument for integrating social, environmental, and development concerns in the entire value chain of corporate business. MCA had issued ‘Voluntary Guidelines on Corporate Social Responsibility, 2009’ as a first step towards mainstreaming the concept of Business Responsibilities. This was further refined subsequently, as ‘National Voluntary Guidelines on Social, Environmental and Economic Responsibilities of Business, 2011’. The Companies Act,2013 for the first-time mandates that private corporations join public sector firms in annual donations for CSR.

Areas of Coverage

- Applicability

- Eligible Activities

- Ineligible Activities under CSR Provisions

- CSR Committee

- Amount to be Spent

- CSR Implementation

- Treatment of unspent Amount

- Treatment of Excess Expenditure

- Penalty for Non-Compliance

- Impact Assessment

- GST Input Credit on CSR Expenses

- Income tax provision on CSR Expenditure

- Monitoring Provisions

- Applicability

A company satisfying any of the following criteria during the immediately during preceding financial year is required to comply with CSR provisions: –

- Net worth > 500 crores

- Turnover > 1,000 crores

- Net Profit > 5 Crores

While computing the net profits for CSR Provisions, company need to make adjustment as per section 198 in Profit before tax which has been calculated as per schedule III.

Provided that in case of a foreign company covered under CSR provisions, net profit means the net profit of such company as per profit and loss account prepared in terms of clause (a) of sub-section (1) of section 381, read with section 198 of the Act.

In addition to adjustment required in section 198, “Net Profit” shall also not include the following namely: –

- Any profit arising from any overseas branch or branches of the company, whether operated as a separate company or otherwise.

- Any dividend received from other companies in India, which are covered under and complying with the provisions of section 135 of the Act.

- Frequently Asked Questions on applicability

- Whether provisions of CSR are applicable to a section 8 Company?

Yes, section 135(1) of the Act commences with the words “Every company……..” and thus applies to section 8 companies as well.

- Whether CSR provisions apply to a company that has not completed the period of three financial years since its incorporation?

Yes. If the company has not completed three financial years since its incorporation, but it satisfies any of the criteria mentioned in section 135(1), the CSR provisions including spending of at least two per cent of the average net profits made during immediately preceding financial year(s) are applicable.

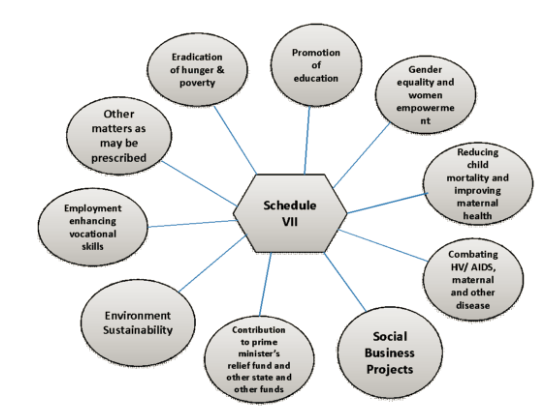

- Eligible CSR Activities

The Board shall ensure that the activities included by a company in its CSR Policy fall within the purview of the activities included in schedule VII. Some activities are specified in Schedule VII as the activities which may be included by companies in their Corporate Social Responsibility Policies.

Provided that the company shall give preference to the local area and areas around it where it operates, for spending the amount earmarked for Corporate Social Responsibility activities:

- Ineligible Activities under CSR Provisions

- Any activities undertaken in pursuance of normal course of business of the company Except any company engaged in research and development activity of new vaccine, drugs and medical devices in their normal course of business may undertake research and development activity of new vaccine, drugs and medical devices related to COVID-19 for financial years 2020-21, 2021-22, 2022-23 subject to the conditions that :-

- such research and development activities shall be carried out in collaboration with any of the institutes or organisations mentioned in item (ix) of Schedule VII to the Act;

- details of such activity shall be disclosed separately in the Annual report on CSR included in the Board’s Report.

- Any activity undertaken by the company outside India except for training of Indian sports personnel representing any State or Union territory at national level or India at international level.

- Any activity undertaken by the company outside India except for training of Indian sports personnel representing any State or Union territory at national level or India at international level.

- Activities benefitting employees of the company.

- Activities supported by the companies on sponsorship basis for deriving marketing benefits for its products or services.

- activities carried out for fulfilment of any other statutory obligations under any law in force in India.

- CSR Committee

Every company having net worth of rupees five hundred crore or more, or turnover of rupees one thousand crore or more or a net profit of rupees five crore or more during the immediately preceding financial year shall constitute a Corporate Social Responsibility Committee of the Board consisting of three or more Directors, out of which at least one director shall be an independent director.

Provided that where a company is not required to appoint an independent director under sub-section (4) of section 149, it shall have in its Corporate Social Responsibility Committee two or more Directors.

Where the amount required to be spent by a company on CSR does not exceed fifty lakh rupees, the requirement for constitution of the CSR Committee is not mandatory and the functions of the CSR Committee, in such cases, shall be discharged by the Board of Directors of the company.

Provided further that a company having any amount in its Unspent CSR Account relating to ‘ongoing project’* shall constitute a CSR Committee and comply with the CSR provisions, even when the amount to be spent by company does not exceed fifty lakh rupees.

- Amount to be Spent

Every company which needs to comply with the CSR provisions have to spend 2% of the average net profits made during the preceding 3 years as per the CSR policy. Net profit for computation CSR Expenditure to be incurred will same as described above.

- Whether Contribution in kind is permissible as CSR or not?

The requirement comes from section 135(5) that states that “The Board of every company shall ensure that it spends…” Therefore, CSR contribution cannot be in kind and monetized.

- CSR Implementation

- Pursuant to rule 4 of the Companies (CSR Policy) Rules, 2014 a company may undertake CSR activities through following three modes of implementation:

- Implementation by the company itself

- Implementation through eligible implementing agencies.

- Implementation in collaboration with one or more companies.

- Rule 4(1) of the Companies (CSR Policy) Rules, 2014 provides the eligible entities which can act as an implementing agency for undertaking CSR activities. These are:

- A company established under section 8 of the Act, or a registered public trust or a registered society, exempted under sub-clauses (iv), (v), (vi) or (via) of clause (23C) of section 10 or registered under section 12A and approved under 80 G of the Income Tax Act, 1961 (43 of 1961), established by the company, either singly or along with any other company; or

- A Company established under section 8 of the Act or a registered trust or registered society, established by the Central Government or State Government; or

- Any entity established under an Act of Parliament or a State legislature.

- a company established under section 8 of the Act, or a registered public trust or a registered society, exempted under sub-clauses (iv), (v), (vi) or (via) of clause (23C) of section 10 or registered under section 12A and approved under 80 G of the Income Tax Act, 1961, and having an established track record of at least three years in undertaking similar activities

- Every implementing agencies, who intends to undertake any CSR activity, shall register itself with the Central Government by filing the form CSR-1 electronically with the Registrar, with effect from the 01st day of April 2021.

- Treatment of Unspent CSR Amount

If a company spends less than the amount required to be spent under their CSR obligation, the Board shall specify the reasons for not spending in the Board’s report and shall deal with the unspent amount in the following manner:

| Nature of unspent amount | Action required | Timelines |

| Unspent amount pertains to ‘ongoing projects’* | Transfer such unspent amount to a separate bank account of the company to be called as ‘Unspent CSR Account’. | Within 30 days from the end of the financial year.# |

| Unspent amount

pertains to ‘other than ongoing projects’ |

Transfer unspent

amount to any fund included in Schedule VII of the Act |

Within 6 months from the end of the financial year. |

*Ongoing Project: Ongoing project has been defined under rule 2(1)(i) of the Companies (CSR Policy) Rules, 2014 as:

- A multi-year project, stretching over more than one financial year.

- having a timeline not exceeding three years excluding the year of commencement.

- includes such project that was initially not approved as a multi-year project but whose duration has been extended beyond one year by the Board based on reasonable justification.

The project should have commenced within the financial year to be termed as ‘ongoing’. The intent is to include a project which has an identifiable commencement and completion dates. After the completion of any ongoing project, the Board of the company is free to design any other project related to operation and maintenance of such completed projects in a manner as may be deemed fit on a case-to-case basis.

# Utilisation of Amount transferred to Unspent CSR Account: such amount shall be spent by the company in pursuance of its obligation towards the Corporate Social Responsibility Policy within a period of three financial years from the date of such transfer, failing which, the company shall transfer the same to a Fund specified in Schedule VII, within a period of thirty days from the date of completion of the third financial year.

- Treatment of Excess Expenditure:

If a company spends more than the requirement provided under section 135, the excess amount can be set off against the required 2% CSR expenditure up to the immediately succeeding three financial years subject to compliance with the conditions stipulated under rule 7(3) of the Companies (CSR Policy) Rules, 2014.

- The excess amount available for set off shall not include the surplus arising out of the CSR activities.

- The Board of the company shall pass a resolution to that effect.

This position is applicable from 22nd January 2021 and has a prospective effect. Thus, no carry forward shall be allowed for the excess amount spent, if any, in financial years prior to FY 2020-21.

- Penalty for Non-Compliance

- The non-compliance with regard the provisions regarding transfer of unspent amount is a civil wrong and shall attract the following penalties:

-

- Company: Twice the unspent amount required to be transferred to any fund included in Schedule VII of the Act or Unspent CSR Account, as the case may be, or one crore rupees, whichever is less.

- Every Officer in Default: 1/10th of the unspent amount required to be transferred to any fund included in Schedule VII of the Act or Unspent CSR Account, or two lakh rupees, whichever is less.

- In case of non-compliance with any other provisions of the section or rules, the provisions of section 134(8) or general penalty under section 450 of the Act will be applicable.

- As per section 134 (8), the company shall be liable to a penalty of three lakh rupees and every officer of the company who is in default shall be liable to a penalty of fifty thousand rupees.

- As per Section 450,the company and every officer of the company who is in default or such other person shall be liable to a penalty of ten thousand rupees, and in case of continuing contravention, with a further penalty of one thousand rupees for each day after the first during which the contravention continues, subject to a maximum of two lakh rupees in case of a company and fifty thousand rupees in case of an officer who is in default.

- Impact Assessment

- The purpose of impact assessment is to assess the social impact of a particular CSR project. The intent is to encourage companies to take considered decisions before deploying CSR amounts and assess the impact of their CSR spending. This not only serves as feedback for companies to plan and allocate resources better but shall also deepen the impact of CSR.

- Rule 8(3) of the Companies (CSR Policy) Rules, 2014 mandates following class of companies to conduct impact assessment:

- companies with minimum average CSR obligation of Rs. 10 crore or more in the immediately preceding 3 financial years; and

- companies that have CSR projects with outlays of minimum Rs. 1 crore and which have been completed not less than 1 year before undertaking impact assessment.

- Impact assessment shall be carried out project-wise only in cases where both the above conditions are fulfilled. In other cases, it can be taken up by the company on a voluntary basis.

- Rule 8(3) of the Companies (CSR Policy) Rules, 2014 requires that the impact assessment be conducted by an independent agency. The Board has the prerogative to decide on the eligibility criteria for selection of the independent agency for impact assessment.

- A Company undertaking impact assessment may book the expenditure towards Corporate Social Responsibility for that financial year, which shall not exceed two percent of the total CSR expenditure for that financial year or fifty lakh rupees, whichever is higher.

- GST Input Credit on CSR Expenses

As per GST provisions, GST Input tax credit can availed on any input of goods or services or both which are used or intended to be used in the course or furtherance of his business.

As prima facie CSR expenses are not business expenditure, but The Telangana AAR, in lieu of an application filed by M/s. Bambino Pasta Food Industries Private Limited, [TSAAR Order No.52/2022] ruled that Corporate Social Responsibility (“CSR”) expenditure for business is eligible for Input Tax Credit (“ITC”) as non-compliance of CSR provisions will attract penalty under section 135(7) of Companies Act,2013 which may go upto one crore rupees. Thus, running of the business of a company will be substantially impaired if they do not incur said expenditure. Therefore, the expenditure incurred for CSR is an expenditure made in the furtherance of the business. Hence, the taxes paid to meet the obligation under Section 135 of the Companies Act, shall be eligible for ITC under provisions of GST.

Further to clarify ambiguity

In Finance Bill 2023, it was clarified by way of amendment to the Central Goods and Services Tax (CGST) Act that input tax credit (ITC) will not be allowed on goods or services used in providing activities relating to Corporate Social Responsibility by way of inserting clause (fa) under section 17(5) which deals with blocked input tax credit.

- Income Tax Provisions on CSR Expenditure

- The amount spent by a company towards CSR cannot be claimed as business expenditure. The Finance Act, 2014 provides that any expenditure incurred by an assessee on the activities relating to corporate social responsibility referred to in section 135 of the Companies Act, 2013 shall not be deemed to be an expenditure incurred by the assessee for the purposes of the business or profession.

Further, no specific tax exemptions have been extended to CSR expenditure. Accordingly, CSR Expenditure u/s 135 of the Companies Act,2013 are not allowed as expenditure under Income Tax.

- Where CSR activities are being carried out by the company itself, the TDS provisions will apply in the same manner as would be applicable on business expenditure.

- Monitoring Provisions

- Companies are required to make necessary disclosures in the financial statements regarding CSR including non-compliance.

- It is recommended that all expenditure on CSR activities, that qualify to be recognised as expense should be recognised as a separate line item as ‘CSR expenditure’ in the statement of profit and loss. Further, the relevant note should disclose the break-up of various heads of expenses included in the line item ‘CSR expenditure’.

- The notes to accounts relating to CSR expenditure should also contain the following:

- Amount required to be spent by the company during the year,

- Amount of expenditure incurred,

- Shortfall at the end of the year,

- Total of previous years shortfall,

- Reason for shortfall

- Nature of CSR activities,

- Details of related party transactions, e.g., contribution to a trust controlled by the company in relation to CSR expenditure as per relevant Accounting Standard

- where a provision is made with respect to a liability incurred by entering into a contractual obligation, the movements in the provision during the year should be shown separately.

- As per Advisory issued by ICAI, Wherever the company undertakes the CSR activity through a third party / NGO, it is advised that all such companies should obtain an Independent Practitioner’s Report on Utilisation of such CSR Funds from the auditor / CA in practice of the third party / NGO, to whom the funds are given by the Company for implementing CSR activity.

- Auditors are required to report on unspent CSR amount under clause (xx) of Para 3 of CARO,2020.

- The Board’s Report pertaining to any financial year, for a CSR-eligible company, shall include an annual report on CSR containing particulars specified in Annexure I or Annexure II of the Companies (CSR Policy) Rules,2014, as applicable

For detailed information on this aspect , please the refer :

- CSR Legislation: MCA e-book

https://www.mca.gov.in/content/mca/global/en/acts-rules/ebooks/acts.html?act=NTk2MQ==

- Technical Guide on Accounting for Expenditure on CSR Activities

https://resource.cdn.icai.org/60115csr48973tg.pdf

- Guidance note on Division I of schedule III issued by ICAI

https://resource.cdn.icai.org/68981clcgc55147-gnd1.pdf

- FAQs on CSR issued by MCA vide circular no 14/2021 dated 25.08.2021

https://www.mca.gov.in/Ministry/pdf/FAQ_CSR.pdf

- Guidance Note of Corporate Social Responsibility issued by ICSI

https://www.icsi.edu/media/webmodules/Guidance_Note_on_CSR_Final.pdf

PDF version is attached: https://dpncindia.com/wp-content/uploads/2023/03/corporate-social-responsibility-under-section-135-of-companies-act-2013.pdf

Disclaimer

The information contained herein is updated till 17th March, 2023 and is in summary form based on Various Rules and notifications, FAQs issued by MCA, Guidance Note & Technical Guide issued by ICAI, ICSI and information available in public domain. While the information is believed to be accurate to the best of our knowledge, we do not make any representations or warranties, express or implied, as to the accuracy or completeness of this information. Recipients should conduct and rely upon their own examination and analysis and are advised to seek their own professional advice. This note is not an offer, invitation, advice or solicitation of any kind. We accept no responsibility for any errors it may contain, whether caused by negligence or otherwise or for any loss, howsoever caused or sustained, by the person who relies upon it.