CBIC issues clarification vide Press release dated 23rd April 2018 on issues regarding “Bill to Ship To” transactions for E-way bill. It clarified that one e-way bill is required to be generated either by supplier or person who ordered the goods as per the prescribed procedure.

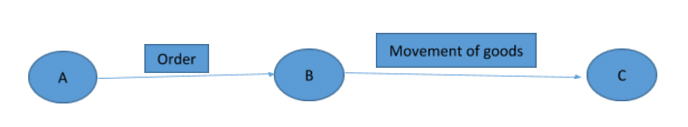

In a “Bill to Ship To” model of supply there are 3 persons involved in a transaction:

- “A” is the person who has ordered “B” to send goods directly to “C”

- “B” is the person who is sending goods directly to “C” on behalf of “A”

- “C” is the recipient of goods

States that where movement takes place from ‘B’ to ‘C’ on behalf of ‘A’, e-Way Bill can be generated either by ‘A’ or ‘B’ in terms of CGST Rules, but only one e-Way Bill is required.

Case-1: Where e-Way Bill is generated by ‘B’, Part A of GST Form EWB-01 will contain –

- Details of ‘A’ in “Bill To” field.

- Details of ‘C’ in “Ship To” field.

- Details of Invoice raised by ‘B’ on ‘A’.

Case-2: Where e-Way Bill is generated in by ‘A’ –

- “Dispatch From” field will contain details of principal or additional place of business of ‘B’.

- “Bill To” and “Ship To” fields will be filled with details of ‘C’.

- Details of Invoice raised by ‘A’ on ‘C’ shall be filled in Part A of EWB-01.