Prerequisite for generating an e-way bill:

a) Registration on the EWB portal.

b) The Invoice/ Bill/ Challan related to the consignment of goods must be in hand.

c) If transport is by road – Transporter ID or the Vehicle number.

d) If transport is by rail, air, or ship – Transporter ID, Transport document number, and date on the document.

Step 1: Login to e-way bill system.

Enter the Username, password and Captcha code, Click on ‘Login’

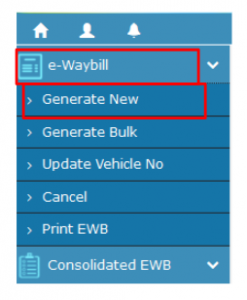

Step 2: Click on ‘Generate new’ under ‘E-waybill’ option appearing on the left-hand side of the dashboard.

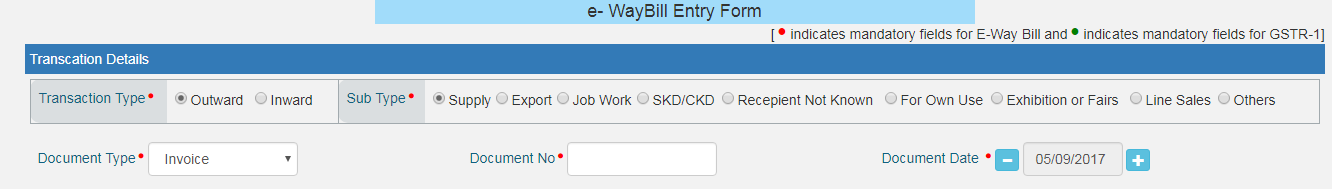

Step 3: Enter the following fields on the screen that appears:

1) Transaction Type:

Select ‘Outward’ if you are a supplier of consignment

Select ‘Inward’ if you are a recipient of consignment.

2) Sub-type: Select the relevant sub-type applicable to you:

![]()

If transaction type selected is Outward, following subtypes appear:

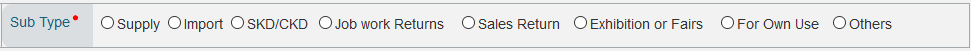

If transaction type selected is Inward, following subtypes appear:

Note: SKD/CKD- Semi knocked down condition/ Complete knocked down condition.

3) Document type: Select either of Invoice / Bill/ challan/ credit note/ Bill of entry or others if not listed

4) Document No. : Enter the document/invoice number

5) Document Date: Select the date of Invoice or challan or Document.

Note: The system will not allow the user to enter the future date.

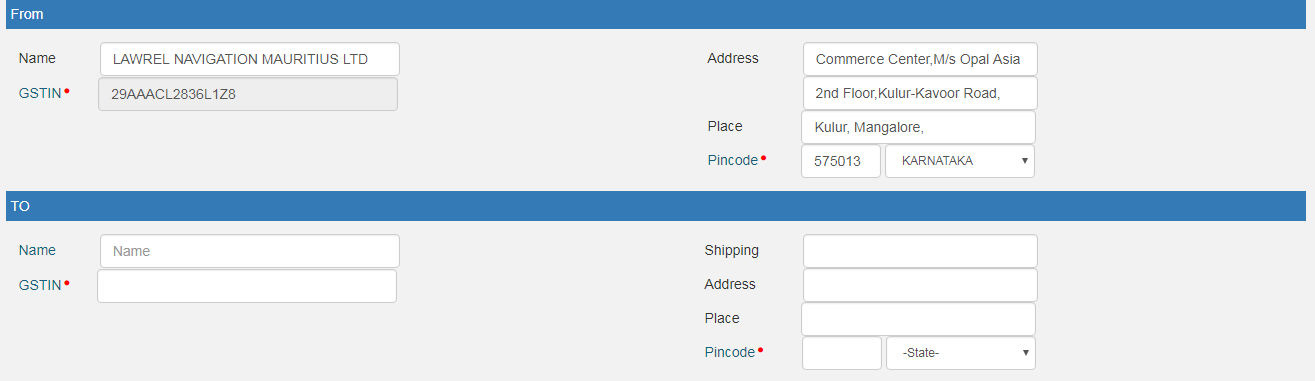

6) From/ To: Depending on whether you are a supplier or a recipient, enter the to / from section detail

Note: If the supplier/client is unregistered, then mention ‘URP’ in the field GSTIN, indicating that the supplier/client is an ‘Unregistered Person’.

7) Item Details: Add the details of the consignment (HSN code-wise) in this section:

1. Product name

2. Description

3. HSN Code

4. Quantity,

5. Unit,

6. Value/Taxable value

7. Tax rates of CGST and SGST or IGST (in %)

8. Tax rate of Cess, if any charged (in %)

Note: On the implementation of E-way bills, based on the details entered here, corresponding entries can also be auto-populated in the respective GST Return while filing on GST portal.

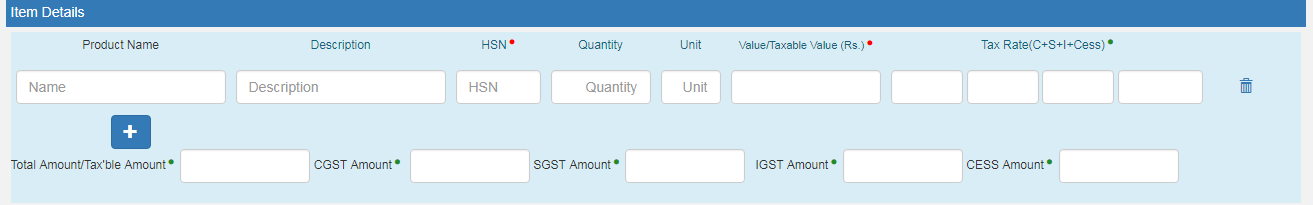

8) Transporter details: The mode of transport (Road/rail/ship/air) and the approximate distance covered (in KM) needs to be compulsorily mentioned in this part.

Apart from above, Either of the details can be mentioned:

1. Transporter name, transporter ID, transporter Doc. No. & Date, OR

2. Vehicle number in which consignment is being transported.

Format: AB12AB1234 or AB12A1234 or AB121234 or ABC1234

Note: For products, clients/customers, suppliers, and transporters that are used regularly, first update the ‘My masters’ section also available on the login dashboard and then proceed.

Step 4: Click on ‘Submit’. The system validates data entered and throws up an error if any.

Otherwise, your request is processed and the e-way bill in Form EWB-01 form with a unique 12 digit number is generated.

The e-way bill generated looks like this:-